Chaos Clinic Recap

Here are Al's comments

1:17 OK, I'm passing on this trade. Thanks for coming. See you next week. Take a course.

1:06 these two brains are the topic of my current book, Thinking Fast And Slow by Daniel Kahneman.

1:04 this is the kind of a market that causes you to stare at the screen. When you do that, your fast reactive brain

starts making things up, and you can make bad judements, which your slow thoughtful brain would normally not make.

1:02 this trade is looking more and more like a pass-I'll give it another 28 minutes

12:59 we are seeing 2 and 3 tick 3 minute candles now - I use this as a message to stay out

12:51 that FOP suggests any drop would come later in the day, and probably only reach about 1342

12:49 passing the trade time with no juice-just watching

12:47 FWIW: I have placed a Fractal of Pi chart in the Certified Chaos Trader's Room. That room is open

to graduates of my 4 main courses. See http://moneytide.com -> Courses for details.

2:38 on the Wheel of Fortune we see prices are making a T square with Jupiter and Saturn-looking pretty stable

12:34 the key Moon aspect today is Moon squaring Venus; their timelines late in the day may add some volatility

12:31 the morning high has now stood for over 2 1/2 hours, so it is probably th high of the day

12:26 as a rule of thumb, one can usually capture about 1/3 of the range on a trade. So right now, a 2 point target

is all I would try for.

12:25 range of the day is only 6.25 points - pathetic volatility.

12:22 from the high, have a thrust down and a correction upward

12:20 I'm back after breakfast and taking Scout and Scamp to the park

11:11 now taking an extended breakfast break -will be back for second trade

11:09 out for +3

11:08 stop to 1357

11:07 stop to 1357.5

11:03 only trying for 3 because of the low volatility today

11:01 stop to 1358.5

10:58 placing buy limit at 1355 - the 440 EXMA

10:55 stop to 1359.5

10:45 so far this is dreadful volatility

10:39 stop to 1360 - above last minor high

10:35 sold 1358 stop 1361 - little continuation sell on 20/55

10:31 gone flat for now

10:26 10:32 is a Natural time and may be a minor high

10:19 just watching

10:14 have 20/55 sell and 20 /110 about to cross

10:09 looks like the rally from yesterday is flattening out-may not see much of a drop

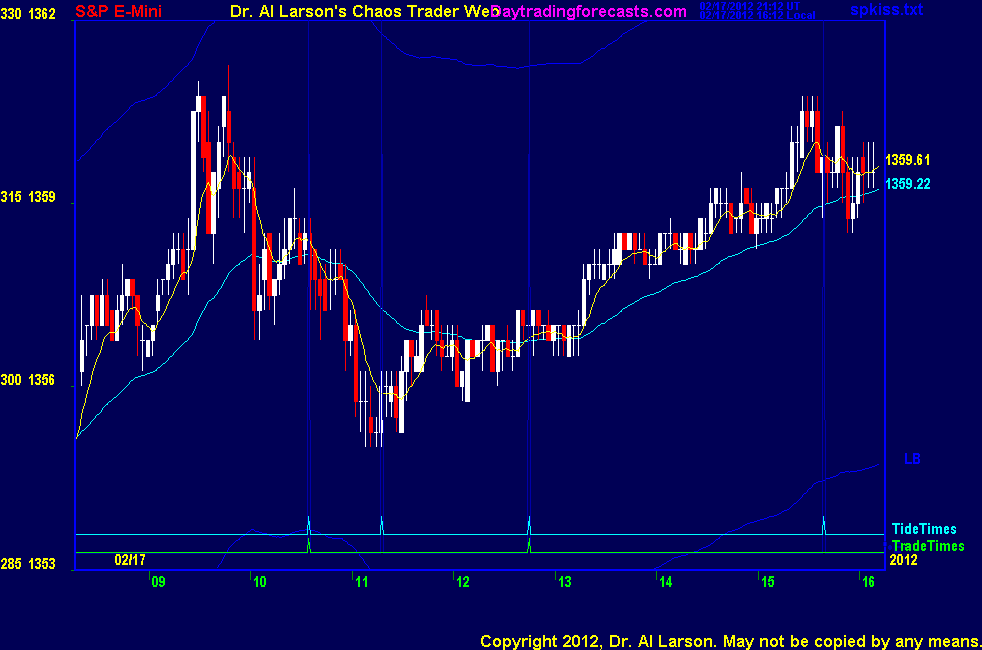

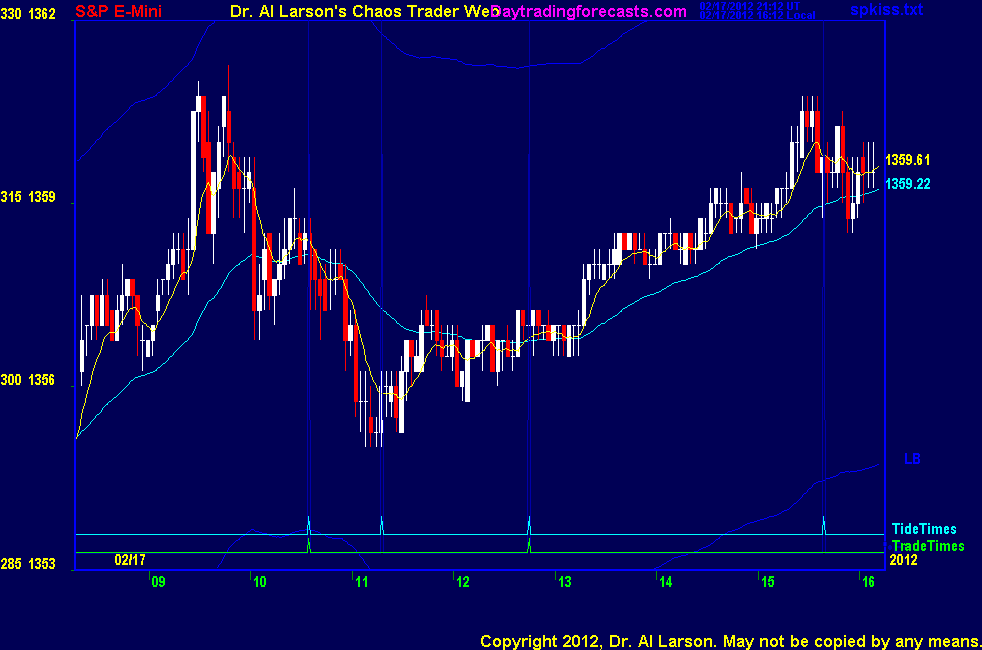

10:00 the SPTideTracker chart shows tracking the green +Tide<

9:50 stalling at high -minor double top

9:44 watching to see if the high at 1361 holds

9:42 the white 440 EXMa on the MTRAinbow chart is up to about 1353.5, so that level is probably support

9:36 starting outcry session with a minor high in an uptrend-plan to just watch until much closer to trade time

9:19 today's trades are 10:35 and 12:45. Looking at the MTRainbow chart, the averages are diverged and

the trend is up. My guess is that volatility will be lower than yesterday.

9:15 Good Morning. Welcome to the Chaos Clinic. This site has a lot of charts,

so you may find it useful to have several of them available within your

browser. If you have a tabbed browser, you can open separate charts

in separate tabs by right clicking on any link, and selecting "open in new tab"

from the menu. The main list of site pages is at

http://daytradingforecasts.com/chartlistsec.asp

Recommended main pages to watch are SPKISS, MTRainbow, and Chat.

For astro stuff, add SPSunMoonMer, Wheel, and Chaos Clinic.

Chaos clinic comments appear at the bottom of the SPKISS, MTRainbow,

and ChaosClinic pages. Comments in the chat room are announced by a

"duck call" noise. This noise also occurs when the sofware detects a

resonant hex pattern on the Wheel page. Trading tutorials

are on the righty side of the ListOfCharts page. One should

read Trading the MoonTide Tutorial and Keep it Simple as a minimum.

9:00 Good morning from Chaos Manor

Besides the comments made by Al, the chat room is has live

comments from other traders who sometimes share their views,

trades and tips. Below are the chat room comments from this clinic

2/17/2012 1:23:07 PM MT BBB****:: Agree. But they are all worth it and you will refer back to them time and time again.

2/17/2012 1:18:30 PM MT astro:: Thank you TG.

2/17/2012 1:17:07 PM MT Tg****:: I felt like CIOC was the introductory course and FOP built on that. After those two, I'd do FOG and then CTME expands on all of the earlier concepts from a "how do I actually make this information useful for trading" perspective. So that's the order I liked but I've heard Al tell people to go straight to CTME.

2/17/2012 1:08:01 PM MT astro:: for those who have taken the courses ... assuming i started with two courses which ones would you suggest? Chaos course and FoG seem most likely candidates, but any input?

2/17/2012 1:04:37 PM MT Tg****:: Al always says +/- 45 minutes around a trade time are what we need to be watching for. When the volatility was above average I'd have a verticle line right on the tide time and one 45 minutes earlier and later than the tide time. Often price was marching right through the 110 exma right on those verticle lines. It still happens now but less often. Maybe I'm wrong about this but now that things are slow it feels like big interests are in the market constantly painting the tape.

2/17/2012 12:57:39 PM MT Tg****:: I did a pretty lengthy backtesting of the astro stuff and a lot of the inflection points in the Natal S&P futures contract did match pretty closely at times to Al's tide times but not always. Based on my backtesting of about 6 months worth of intraday charts I found the wave59 astro stuff to be pretty good but I found Al's moontide timings we get here to be generally more accurate.

2/17/2012 12:17:28 PM MT BBB****:: Tg - the word jealousy comes to mind! Did you ever use any of the other astro stuff that wave 59 offers? it does seem like the Harmonic Index they have is similar to Al's Xtide2...

2/17/2012 11:55:53 AM MT Tg****:: BBB I was a long time user (several years) of wave59 and I really liked it, especially for the access to Al's overlays. But that was when I traded via a workstation in an office with 4 3x4 format monitors. When I moved to Singapore had to simplify and went with a Sony VAIO laptop with a Hi-def monitor plus a 2nd 16x9 format monitor. Instead of trading from a desk against a wall I trade from a plush recliner with each monitor on a tray table and just watch a 1 minute eSignal chart and a 3 minute one. For live trading I think the simpler more comfortable format I have now is better than having multiple charting software and more charts. Wave59 was stronger than eSignal for backtesting beyond the past few months and I do miss that aspect of it.

2/17/2012 11:09:55 AM MT Tg****:: lots of 2 tick 1 minute bar doji candles and a flat as a pancake 110 exma for over an hour. The cyclicality of volatility is interesting. 2nd half of last year was so much like 2nd half of 2008, similar to early 2009 got a good bump up with most of it on gaps and more quiet days than good ones.

2/17/2012 9:28:48 AM MT Al****:: BBB-I go by the EXMA's as on my MTRainbow chart. These are computed using one minute bars and only data in the 8:15 - 4:15 Eastern time frame. Other systems may get somewhat different values.

2/17/2012 9:28:04 AM MT AG:: BBB - check MTRainbow chart.

2/17/2012 9:22:54 AM MT BBB****:: Al (or anyone) on the 1355 target you said was the 440 EXMA - on both my 1 minute and 3 minute charts, the 440 was not at 1355 --- am I missing something? (I use EXMA of course)...

2/17/2012 8:54:10 AM MT sdg:: "dullness before chaos" - Al

2/17/2012 8:29:10 AM MT Al****:: Eastern

2/17/2012 8:19:29 AM MT astro:: are the suggested trade times in mountain or eastern time?

2/17/2012 8:00:25 AM MT BBB****:: I have esignal through my workplace and don't know about IB. Sorry.

2/17/2012 7:51:22 AM MT sdg:: BBB- Wave 59 appears compatible with IB data feed as well. Do you know the difference b/w the two?

2/17/2012 7:41:17 AM MT BBB****:: Tg - do you recommend it and use it? sdg - I have looked at wave 59 and if you can get a data feed from esignal it will use that. I think it is only $90 a month if you have a feed.

2/17/2012 7:37:54 AM MT sdg:: Data feed; Wave 59 or IB? Right now, I would be charged at the professional levels, so trying minimize cost and reduce redundancy.

2/17/2012 7:35:10 AM MT Tg****:: it's in the program.

2/17/2012 7:23:43 AM MT BBB****:: Al,

I have been looking into the WAve59 and did not realize that FOP and FOG could be used on there. Is it in the programs or is it still just using Mylar overlays?

2/17/2012 7:11:19 AM MT sdg:: Thanks Al, that was my first choice on brokers. Not familiar with Wave 59, but will do the research.

2/17/2012 7:04:01 AM MT Al****:: GM all-good luck today

sdg: Interactive Brokers is excellent. Many of my clients like Wave59 since it can do the FOP and FOG patterns after you take my courses.

2/17/2012 6:56:06 AM MT sdg:: Good morning all. I have been watching Al for probably close to 10 years and ready to pull the trigger (life-long goal of trading for a living). Looking for recommendations on software and brokers, thanks!

2/17/2012 5:27:46 AM MT mm****:: gm all - have a great day

9:00 Eastern-System: No comments

[ Live Clinics on Friday on DaytradingForecasts.com ]