Chaos Clinic Recap

Here are Al's comments

3:37 I'm done for the day. Hope you learned something about trading dull days. Thanks for coming. See you next week. Take some courses.

3:35 I give thanks and quit now. Narrow range days can be traded, but it takes patience, skill, and good tools.

3:34 out 1331 for +4.5

3:31 updated my fractal grid chart in the CCT room-it nailed this up streak

3:29 stop to 1368; recall I have a 1371 cover order in

3:37 from the low I see a small 1-2-3-4, not starting a 5 move

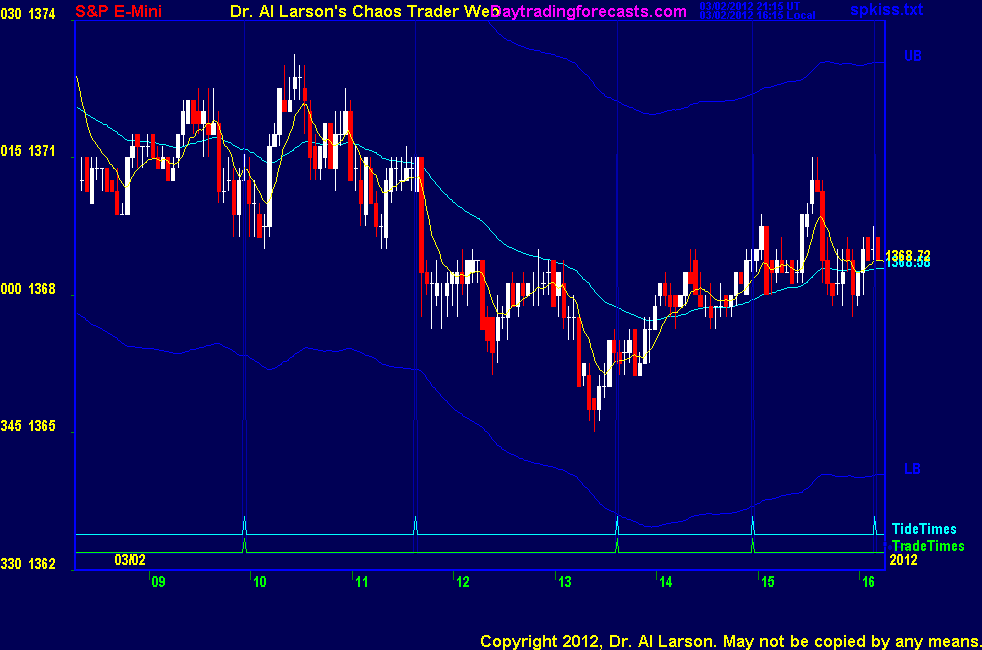

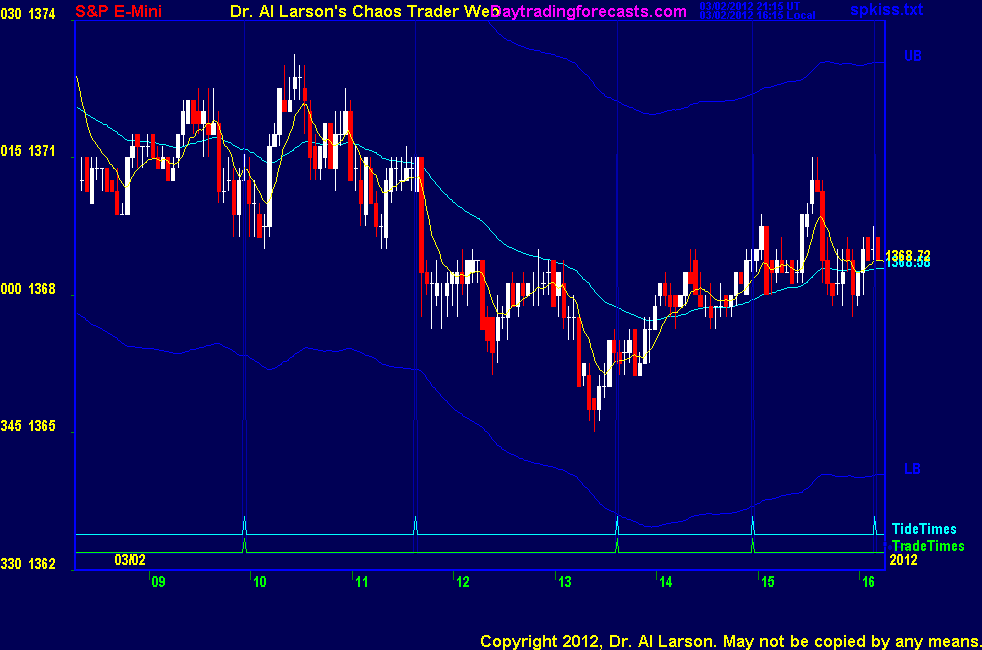

3:17 I work to keep things simple-here just watching the SPKISS chart-it has all the information I need

110 EXMA is up, my stop is just below it, so no need to fill my head with other info - just takes too much energy

3:10 I think we are inverting to the green +Tide -stop is in with a small gain; riding the Moon +T270 electric field flux

3:02 updated my FOG chart in the CCT room; stop to 1367

2:59 holding fast

2:48 I will just carry this trade through the third trade time

2:42 on Fridays, if market hold up past 2:30, usually get some short covering

2:40 stop to 1365.75-lock a giant one tick :)

2:34 stop to 1366.5

2:22 we could get above 1371, but that was resistance near 11:30, so it is a good enought target for me

2:20 here it would be real easy to start hallucinating about a big move and not use a reasonable target

2:17 there is no way to really predict the direction of that MoonTide discontinuity near 3:00, but it could be up as per the red -Tide

2:14 updated my fractal grid chart in the CCT room

2:10 OK, entering a sell limit at 1371, 6 points above the low; if I get that, I will give thanks and quit for the day

2:04 stop to 1365.5

2:00 so far so good-trding dull days is hard-using my pattern emylar overlays helps

1:55 in making this entry, I knew I did not want to risk more than 2 points, and a stop had to go .5 under the low

that dictated my entry price choice.

1:53 on the Tides, we followed green early, now red, probably end on green; get this often on dull days

1:47 pressing a bit based on FOG and Tide Tracker saying on red -Tide - bought 1366.5 stop 1364.5

1:43 if low holds for about 30 minutes, it will attact buying

1:40 low came as we passed the Moon and Mercury timelines

1:33 down for about 3 hours, 1/8 of day

1:31 watching for an upturn

1:28 placed a Face of God chart in the CCT Room

1:24 want to wait until past the Tide Time

1:22 waiting

1:17 marginal new low-waiting

1:13 still quiet

1:02 in the second trade window, but just watching

12:55 a fine detail on that chart-the biggest 3 minute bar of the day came very close to the little vertical

part of the MoonTide near 11:36-this comes from a discontinuity in the equation. We have another one near the third trade time

12:52 this fractal pattern suggests the last two trades may be passes

12:43 if you look at the SP Tide Tracker chart, you see that the green and red MoonTide lines make a pattern

very much like a Mandelbrot set-this one is a MoonTide Fractal set

12:28 from the high near 10:28, I see 7 small swings-a small down Chaos Clamshell.

12:19 many of my discoveries have come from placing a mylar sheet over a screen, sketching, and measuring.

when I do that on a two day chart I can draw a horizontal line at 1368 and an arc over the top of prices.

these meet about 13:20 or so. This suggests possible increase in energy near the next trade time.

12:10 on the Wheel, see Jupiter, then Venus set highs, and below have Sun/Neptune/Chiron support.

11:59 if you look on the Wheel of Fortune page, you see that the Moon is vertical at 90 degress, squaring Mercury/Uranus

prices are stuck on Mercury/Uranus. Market Astrophysics in action

11:54 I updated that chart. The CCT room lets CCTs post charts and discuss them in a secure environment.

11:50 I have added my own Fractal Grid chart to the CCT Room

11:43 in slow markets, one of the better tools to use is the Fractal Grid from the Chaos Trading Made Easy course.

regular BB has placed a chart with a Fractal grid in the Certified Chaos Traders Room. That room is open

to graduates of my 4 main courses. See http://moneytide.com -> Courses for details.

11:42 looking weak here-may try a non hotline trade

11:37 on two day chart, see flat at 1371 plus/minus noise

11:35 I'm back-had breakfast and took Scout and Scamp for a walk-important on dull days not to sit an stare

10:40 taking a break for breakfast now

10:34 stopped for -2. That's OK. have two more trades today, and about 10 to 15 next week.

On low volatility days, the odds of a trade not working are higher, so one needs to control the loss, and not lose patience or poise.

10:27 now high, moving stop up to 1371, just under the 110 EXMA

10:25 moving sell stop up to 1370.5 -control my risk

10:22 increasing my target to 2 points, setting sell limit to 1375; have 20/110 crossing above the 440

10:18 elected long, moving sell stop up to 1370

10:16 placing a sell limit order at 1374

10:14 this narrow range indicates a target of 1 point

10:12 placing a buy stop at 1373, .5 above the high

10:10 trying to turn up-range of day just 3.5 points

10:08 stop not hit, adjusting to 1368.5

10:02 have 20/110 sell, but I don't blindly jump-I want some juice

10:00 passing trade time. No juice yet. Placing sell stop .5 under low, at 1368.75

9:56 in daytrading, it is very important fo use profit targets, and not count on long trends with trailing stops.

A target of .25 or .33 of the recent daily ranges or expected range is good. Today I expect a range of 9 or less,

so a 2 - 3 point target is reasonable.

9:52 getting some selling going into the trade time. I want to see how we come out of the trade time.

9:50 I watch the top and bottom wicks on the 3 minute candles-here the top wicks show resistance overhead at 1372.5

9:48 I pay attention to the size of the 3 minute candles. Candles of 3 or fewer ticks say there is no excitement.

9:44 In this case, we have a flat 110 and 440 EXMA, so rate of movement is small

9:42 when volatility is low, I usually wait until the trade time before making an entry.

9:35 Low range days tend to come in streaks. If you look at the hotline track record, you see low volatility

periods tend to come every 11 to 13 months, and tend to last 4 to 6 weeks. So wixhing for a better day is pointless.

9:29 today's trade times are 09:57, 13:37, and 14:57; I expect another low range day

Traders have to learn to deal with such days, so I'll talk about that today.

9:15 Good Morning. Welcome to the Chaos Clinic. This site has a lot of charts,

so you may find it useful to have several of them available within your

browser. If you have a tabbed browser, you can open separate charts

in separate tabs by right clicking on any link, and selecting "open in new tab"

from the menu. The main list of site pages is at

http://daytradingforecasts.com/chartlistsec.asp

Recommended pages to watch are SPKISS, MTRainbow, and Chat.

For astro stuff, add SPSunMoonMer, Wheel, and Chaos Clinic.

Chaos clinic comments appear at the bottom of the SPKISS, MTRainbow,

and ChaosClinic pages. Comments in the chat room are announced by a

"duck call" noise. This noise also occurs when the sofware detects a

resonant hex pattern on the Wheel page. Trading tutorials

are on the righty side of the ListOfCharts page. One should

read Trading the MoonTide Tutorial and Keep it Simple as a minimum.

9:00 Good morning from Chaos Manor

Besides the comments made by Al, the chat room is has live

comments from other traders who sometimes share their views,

trades and tips. Below are the chat room comments from this clinic

3/2/2012 1:58:39 PM MT srj****:: (That I could Find)

3/2/2012 1:58:09 PM MT srj****:: In terms of copies - only a public Library in FL has a copy.

3/2/2012 1:57:06 PM MT srj****:: Last time I phoned Wilbur register - they said some one else also wanted it - but they had contact only to one of the daughter-in-law of Owen Lehto and She looked after matters related to the book. May be time to check again.

3/2/2012 1:54:37 PM MT AG:: I received an e-mail from the distributor today saying the book is out of print and that they do not carry it in inventory.

3/2/2012 1:53:49 PM MT Al****:: I just got an email from Acres USA saying the book is out of print, and the page found is an old one cached by Google.

3/2/2012 1:51:17 PM MT srj****:: Please ask MS if he got the book - last time I ordered but found out I think the order handling company might have back dated pages.

3/2/2012 1:49:32 PM MT srj****:: Al I did and sent you an email.

3/2/2012 1:48:27 PM MT Al****:: srj: hope you saw the note re: Vibrations

3/2/2012 1:46:17 PM MT Al****:: thanks-simple 3 point harmonics

3/2/2012 1:43:01 PM MT srj****:: Awsewome trade and call Al - you nailed the 1371 top

3/2/2012 1:40:36 PM MT Al****:: nice BBB-keep up the good work

3/2/2012 1:35:26 PM MT BBB****:: Al - ironically on a down grid (i updated mine too) this streak came right as prices past the last grid line.

3/2/2012 1:34:43 PM MT SSP:: im done for the day cu folks monday the mighty bull continues

3/2/2012 1:21:32 PM MT SSP:: If one of u more experienced guys cud look at aapl daily and tell me if thats a 7 ?

3/2/2012 1:02:59 PM MT SSP:: there was no way the mkt was going to drop with aapl in this tight range its been the leader

3/2/2012 12:59:05 PM MT SSP:: AAPL putting in a really small range inside bar today at the Highs

3/2/2012 12:30:32 PM MT SSP:: might get a cross here too (wishful thinking lol)

3/2/2012 12:26:40 PM MT SSP:: looks to me like this could be 6 and another leg what do u think?

3/2/2012 12:23:50 PM MT SSP:: ya was looking at that bbb and we have the 14:57 coming close :)

3/2/2012 12:22:49 PM MT BBB****:: triple top there 1369

3/2/2012 12:22:20 PM MT SSP:: surprised we got this much of a down move with the GS and AAPL in sideways markets

3/2/2012 12:11:38 PM MT SSP:: wonder if we close the gap today

3/2/2012 11:55:46 AM MT AG:: Simple enough ;)

3/2/2012 11:35:05 AM MT Al****:: AG-no.

3/2/2012 11:25:26 AM MT BBB****:: Wait till you see the updated grid.

3/2/2012 11:18:26 AM MT AG:: Al, does the direction of the corresponding move in the discontinuity ever give you a reasonable gauge as to which MT is dominant? I've noticed sometimes that even though the discontinuity points down (and the market also goes down) that it doesn't necessarily mean we end up following that MT.

3/2/2012 10:49:31 AM MT SSP:: none of the big name stocks are selling off there mostly in ranges

3/2/2012 10:23:32 AM MT Tg****:: A lot of times both directions will have periods in the day when they are both working. Unless a definitive down move takes place to take price clearly to the downside OOB (not just a touch and reverse off of it) don't be surprised to see the up FG working off of the early upstreak.

3/2/2012 9:38:21 AM MT BBB****:: Move 4 of 7?

3/2/2012 9:20:04 AM MT BBB****:: Tg- check the CCT room. I did the grid as if the initial thrust down was impulsive, and it is seeming to fit.

3/2/2012 9:15:19 AM MT SSP:: blow the stops at the lows and bounce again ? we shall see lol

3/2/2012 9:04:07 AM MT SSP:: Tests and probes fits and stalls

3/2/2012 8:59:05 AM MT SSP:: another fun day in a melt up bull market friday

3/2/2012 8:34:47 AM MT BBB****:: Good Point. I don't see it colored to the upside either, so I guess we just wait to see what pans out?

3/2/2012 8:31:53 AM MT Tg****:: BBB, was it a chaotic thrust or just a corrective thrust. Looking at Al's CTME chart I don't see the QPFE colored up to the downside.

3/2/2012 8:28:50 AM MT BBB****:: Al, on a day like today with the initial thrust down, would you be looking to use a down grid or an up grid? This always confuses me...

3/2/2012 8:26:15 AM MT Tg****:: On a chart just using the outcry session, price squatted on the lower 55 minute donchian channel for a while without breaking it(four 1 minute candle touches) then popped up.

3/2/2012 8:17:17 AM MT BBB****:: You should run and set up your own chart to show real time since Al's lag a bit. THat way you can set up your own colors

3/2/2012 8:17:17 AM MT BBB****:: You should run and set up your own chart to show real time since Al's lag a bit. THat way you can set up your own colors

3/2/2012 7:49:16 AM MT ms:: what colors are the 110 and 440 exma's?

3/2/2012 7:42:02 AM MT Al****:: Wave59 is all the work of Erik Beane. He was a student of my basic 4 courses. I did help him very eary on when he was just starting it as a recent college graduate. I told him I sure

did not want to do a real time trading program, because of the support demands and the challenge. Erik wanted to do one. He figured it would take him a few months. A couple of years ago he told me it took him 7 years to get it all working right. That's dedication

and persistance. My hat is off to him.

3/2/2012 7:29:39 AM MT BBB****:: I have been on Wav59 for 2 weeks and like a few of the options it has. ITs 9-5 count is great, and the Ultra-smooth momentum is excellent. Works well with Al, in my opinion.

3/2/2012 7:15:55 AM MT sdg:: Great, thank you. Very interesting demos; can't help but think that you may have played a large part (directly or indirectly) in that development.

3/2/2012 7:12:24 AM MT Al****:: sdg: the MoonTide trading times are from a complex calculation, not found from an ephemeris-the wave 59 ephemeris is similar to my Wingephi program

3/2/2012 7:04:11 AM MT sdg:: GM all--Al, reviewing wave 59 per your suggestion. Are the times that can be established from the ephemeris similar to your trading times?

3/2/2012 6:37:27 AM MT Al****:: GM all-good luck today

3/2/2012 6:37:10 AM MT Al****:: SSP: in low volatility times taking 2 or 3 points is a good tactic

3/2/2012 6:04:29 AM MT SSP:: question: Yesterday I had the nice short on the cross but ended up breaking even on the trade is there anything I should have seen that indicated to take profits ?

3/2/2012 6:01:32 AM MT SSP:: gm all, nice move on the EUR over night.

3/2/2012 5:41:41 AM MT mm****:: gm all - have a great day

9:00 Eastern-System: No comments

[ Live Clinics on Friday on DaytradingForecasts.com ]