10:25 that's the first trade; on a holiday weekend, if the first trade lacks sufficient juice, it's usually

best to quit and go do something else. That's what I'm going to do. Thanks for coming. See you next week. Take some courses.

10:20 now I see that my stop was perhaps too close; but it was what I was willing to pay at the moment; for a pretty marginal product;

10:20 got selling near R1; dropped prices down to my stop; I'm out; paid $25 for the opportunity and excitement

10:18 here is where I feel a surge of confidence and maybe over confidence- suddenly I'll dream far this could go

10:16 raising stop to 2091, just below the 110; now I'm paying $25 for a product worth $100

10:15 here I have to be open to the possibility that there will be more juice today than I expected

10:11 raising my stop to 2090.5, so risk $50; now I'm paying $50 for a product worth $50

10:09 my product is worth $50 but looking better

10:04 A good exercise is to write down a series of numbers, say form $100 to $10000, and then write a pain number

beside each. Start by thinking of the pain number like the medical people do- for 1 to 10; but let it go higher if

needed. You will learn something about your risk tolerance. Too much pain causes fear; fear causes you to narrow

your focus, and that causes you not to see all the possibilities. Fear is what defeats traders.

10:02 It is important that you know the actual amount that you are risking; it has to be in the range of

money you are used to dealing with mentally

10:01 that's about the price of a cheap concert ticket; I'll hold

9:58 product value went to -$37.50 ; so I must accept that I could pay $75 just for the fun of playing the game

9:55 now it's back to worthless

9:51 new highs, raising stop to 2090, under the 440 EXMA; cutting my bill to $75 for a $50 product

9:48 the 110 has clearly curled up, so raising stop to 2089; this cuts my unpaid bill to $125 for a worthless product

9:45 right now that $150 bill is for a product worth $50 ; of course, you hope its value will increase

9:42 stop to 2088.5; risk 3 points; it is important to think about how you feel about this risk.

Suppose it was a surprise bill for $150. How painful would it be?

9:38 the fast EXMAs have turned up

9:35 elected long 91.5; stop at 2088 for now

9:34 putting buy stop 91.5

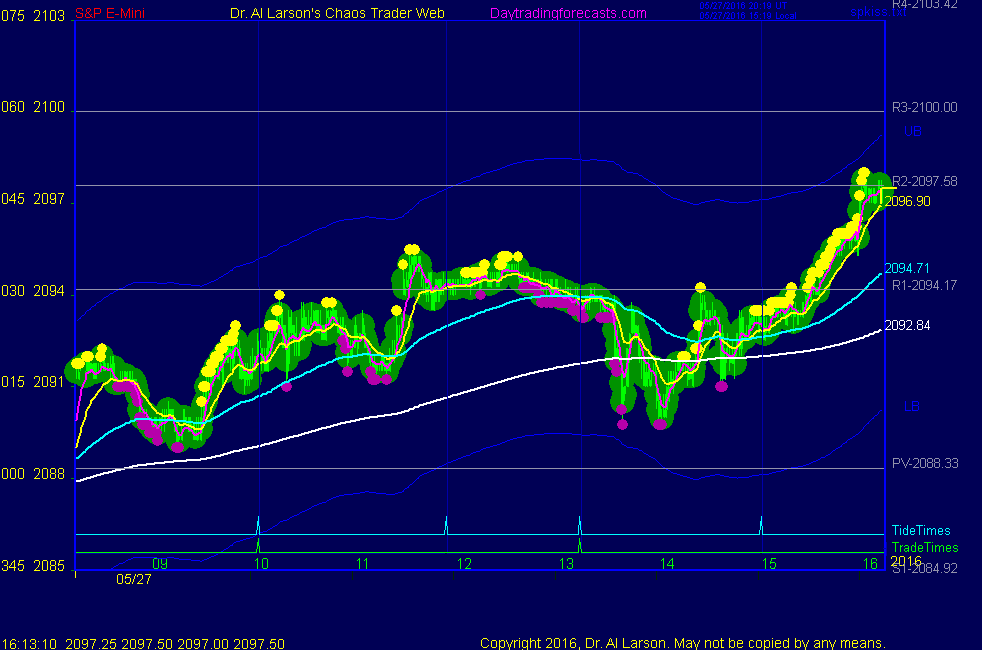

9:33 yellow pushball; high 91

9:32 normal session open; a bit of buying

9:28 with this week's rally, I don't see any big down move, so I'm not interested in selling

For buying, I'd like to see some juice to the upside and the 110 to turn up

9:26 on the spKiss chart we are in a minor decline, the 440 is flat, the 110 is down, and support is at

the pivot price of 2088.33; currently looks like tracking green +Tide

9:18 today's trade times are 10:05 and 13:15 ; the dullness of yesterday continues

this morning, so there may not be a good trade setup;

9:00 Good Morning. Welcome to the Chaos Clinic. This site has a lot of charts,

so you may find it useful to have several of them available within your

browser. If you have a tabbed browser, you can open separate charts

in separate tabs by right clicking on any link, and selecting "open in new tab"

from the menu. The main list of site pages is at

http://daytradingforecasts.com/chartlistsec.asp

Recommended pages to watch are SPKISS, MTRainbow, and Chat.

For astro stuff, add SPSunMoonMer, Wheel, and Chaos Clinic.

Chaos clinic comments appear at the bottom of the SPKISS, MTRainbow,

and ChaosClinic pages. Comments in the chat room are announced by a

"duck call" noise. This noise also occurs when the sofware detects a

resonant hex pattern on the Wheel page. Trading tutorials

are on the right side of the ListOfCharts page. One should

read Trading the MoonTide Tutorial and Keep it Simple as a minimum.

9:00 Eastern-System: No comments