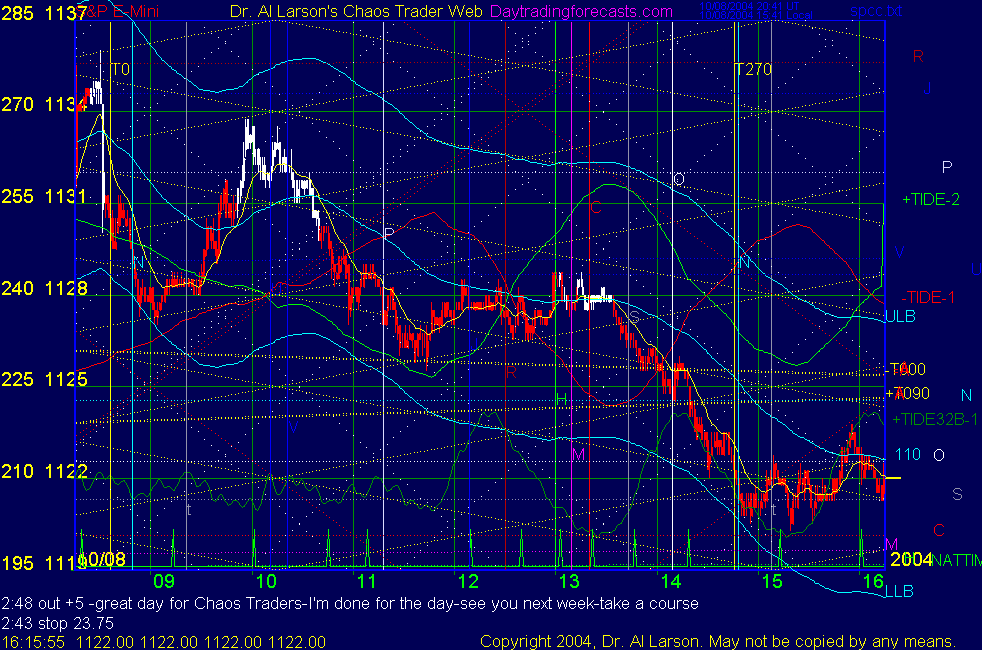

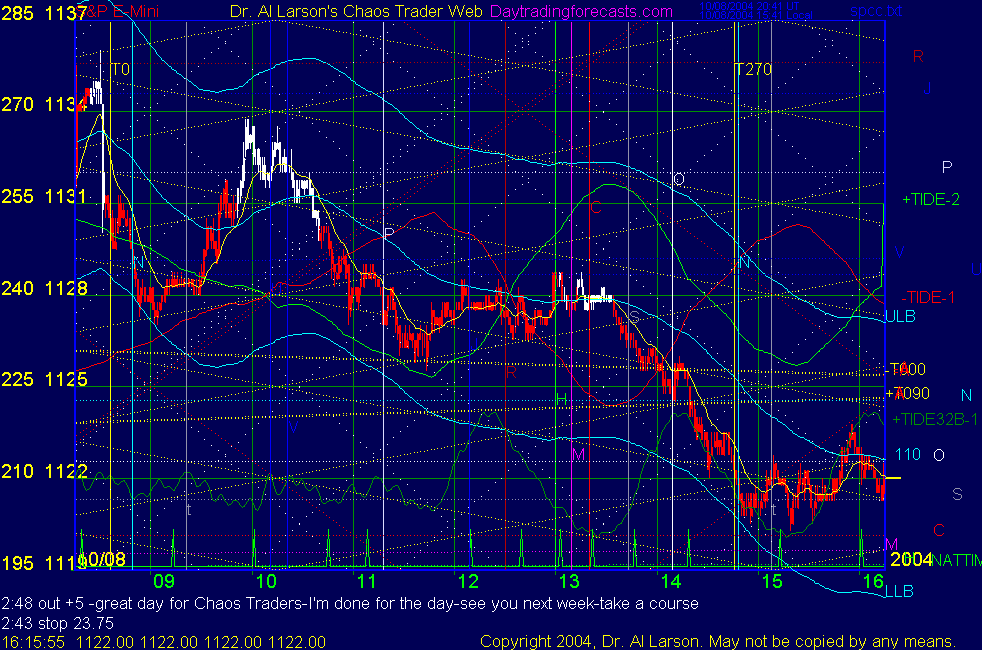

Chaos Clinic Recap

Here are Al's comments

2:48 out +5 -great day for Chaos Traders-I'm done for the day-see you next week-take a course

2:43 stop 23.75

2:37 stop 24

2:31 made node price-stop 24.75

2:27 Chiron timeine was just before down turn-Chiron price is 1120, so maybe-have my cover order in

2:25 stop 25.75-5 point cover is 21.25 if we get there

2:21 -broke that - stop 26-will cover commission

2:17 congestion betwen the two Moon flux lines -stop 26.75 -110 EXMa still down

2:12 little blip as we pass the Node timeline-just work the stop

2:04 stop 27--may get move to node price of 22.5-but just focus on the stop

2:01 stop 27.5 -so far, so good

1:55 support on -T000 Moon flux, below it at 24.25 is +T090 Moon flux -they balance at 1125-18 points below yday high

1:50 stop 27.75 -lidke the curl on the 110, the separation of the 20 from the 110, and slope of price

1:45 stop 28.25 -above the 110 EXMA

1:42 sold 26.25 stop 29.25 -need to be careful

1:38 continuation sell setup-watching for follow through

1:35 as we come to the end of the day we have both a Moon and a Node timeline-should increase volatility

1:30 very close to 3rd trade time-still flat-the Moon flux stopped the drop, but didn't bounce it up

1:18 completely flat-both 20 and 110 flat and tangled-still loos like green +Tide but squashed

1:02 coming into this Tide turn getting a little lift-may get a buy setup later

12:55 it is likely that the range of the day has been set-after the bears wear out, may get a late rally

12:29 passing on this trade-no crossing, 110 EXMA curling up, so no continuation sell

12:12 When I have 3 trade times, like today, I am most suspicious of the one in the middle of the day

12:10 110 EXMA stopped rally for now

12:03 the essence of chaotic markets is that they balance and congest half the time, then they make

chaotic moves to a new balance point, and congest again-the key is to trade the chaotic moves, not the congestions

So it helps to have tools to find when the chaotic moves might come-that's what's in my courses

11:58 notice: 30 minute plunge,1 hour rally, two hour decline; speed=emotion-things are calming down

11:53 that low was on time and almost on the pit Support 2 price-some people trade that setup

but I just use the rules I developed because I know they work over time

11:47 low right on time-may get a 20/110 buy - do not try to take every trade -be patient

11:38 a rally off the Moon flux is probable-cannot take as out of band buy by rule

11:28 low failed-down to the -T000 Moon flux -8:30 high on Moon time -now move to Moon price

11:21 3rd low at 1127 as pass Pluto timeline-no trade setup yet

11:14 the slope of the 110 EXMA matches that of the green +Tide for last half hour, so now on it

11:07 double bottom at 1127 for now-not out of band, not crossing going into next Tide turn

10:58 back to retest the lows-just below is the -T000 Moon flux

10:42 prices both sides of the 110 EXMA - congestion-back off and watch-learn to wait a lot

10:35 before 9:30 outcry open, looked like on green +Tide-then inverted to red -Tide-so now have

the possibility of a mixed tide day-typically 2 inversions, like green,red,green or red,green,red

10:13 Most news items can be interpreted either bullishly or bearishly, sometimes both-I watch for

possible emotional ones-the jobs report was released as the Moon was overhead the exchange-good for

an emotional reaction -note the drop was exactly 9 points, a harmonic number

10:01 that was not quite what the forecast told me to expect, but it did tell me to look for a

trade early-from there I just watched the 20 and 110 EXMA's and applied the rules-keep it simple

10:00 after a fast drop and a fast rally, we may now see some congestion

9:56 out +4

9:55 my cover price is 1133, stop 1130

9:54 here prices got above the 110 EXMA, so now probable that they go as far above it as they went below it

9:53 This is a classic oob setup -oob setup just looks for a reversion to the mean, the 110 EXMA

9:49 stop 1129.5 -now holding 1131 going into the crossing on the yellow diagonal MoonTide Harmonic grid

9:43 stop 1129 -using the 20 EXMA as my guide

9:40 support on horizontal blue Venus flux line suggests up until vertical Venus timeline near 10:30

9:35 stop 1128-press fast in this case-rally already back to the 110 EXMA

9:33 good out of band buy setup-bought 1129 stop 1126

9:15 Sharp drop early on bad jobs report - with the trend trade not there right now

9:00 Good morning from Chaos Manor

Besides the comments made by Al, the chat room is has live

comments from other traders who sometimes share their views,

trades and tips. Below are the chat room comments from this clinic

10/8/2004 8:55:52 AM Mountain mjs:: I am looking for sideways or a possible turn up. How strong is P? Looks like on the WOF prices like it and are moving along it to to it.

10/8/2004 8:45:34 AM Mountain mjs:: that is how my clamshell would look too. Up-down-up so would have to change over on the tide turns to make it work out

10/8/2004 8:41:47 AM Mountain mjs:: I put my template on the screen using the open as the beginning of a clamshell. by 11:45 should be in leg 3 and up as I am thinking the Node 1141 is pulling up

10/8/2004 8:32:30 AM Mountain Al:: interesting site, thanks

10/8/2004 8:28:29 AM Mountain mjs:: I found a website that says there is a relationship in brain waves and the Fractal of Pi plus the brain may be hard wired to harmonics. They are also looking at heartbeats etc. A kin to your methods of looking at market emotions I think http://www.soulinvitation.com/brainphire/ is the site

10/8/2004 8:24:58 AM Mountain Al:: Use your knowledge to get you to the right battle, when in the battle, don't think, just do it and keep it simple

10/8/2004 8:22:12 AM Mountain mjs:: So there are the tools on the chart and the tools in your head to use.

10/8/2004 8:21:53 AM Mountain Al:: an attractor can operate over a long time-it just says it will

limit the downside today

10/8/2004 8:19:50 AM Mountain mjs:: there is a comment about the Node 1141 but the date is Oct 13 it is identified as an "attractor" so does that mean the expectation is up to there. That seems a long way off in time to action today.

10/8/2004 8:16:01 AM Mountain mjs:: The last 3 clinics the trades were being taken off the crossover of the 20/110EXMA. I kept thinking there must be a way to trade the retrace and glad I got to see it here.

10/8/2004 8:14:05 AM Mountain mjs:: it was a very nice trade. seeing some clues as to how it was identified and traded. Looks like the 20EXMA was the biggest key outside experience and knowing the chances for a retrace to the mean 110EXMA. Still nice trade.

10/8/2004 8:06:21 AM Mountain mjs:: I will have to look in the courses for more on this OOB. Unless it is in the FOG I haven't purchased yet.

10/8/2004 7:54:23 AM Mountain Al:: This is a classic oob setup -oob setup just looks for a reversion to the mean, the 110 EXMA

10/8/2004 7:52:59 AM Mountain mjs:: so the fast turn in the 20EXMA and the hi slope was the tip off at 9:33. But still seems like there was an expectation of this reversal.

10/8/2004 7:47:26 AM Mountain mjs:: once out of band is the assummption prices will return? or it this more experience of trading this type news?

9:00 Eastern-System: No comments

[ Live Clinics on Friday on DaytradingForecasts.com ]