Chaos Clinic Recap

Here are Al's comments

3:02 We are now out of the trade window, so I'm quitting. Thanks for coming. See you next week. Take a course.

3:00 normally, the big guys will hold it up last hour Friday, but these are not normal times

2:58 may resell if get some down juice

2:56 out for zero, not going

2:52 backed stop off to 68, above the 110, held for now

2:44 stop to 967, just above 20 EXMA

2:40 stop 70, will try go Big rule

2:39 elected short 62, stop 72

2:38 candle wicks tell me that I can put a buy stop at 72 if I'm elected short

2:35 after 2 days of rally, I expect distribution into the close, so no big upside

2:32 prices back up to 110; just watching with sell stop at 62

2:30 often will get a counter move on the crossing, so I use 3 minute candles and support and resistance as well

2:29 20/110 crossing, will sell break of 63

2:25 support on 963, waiting

2:22 dropped to 966 support back about an hour; 963 should triagger sell on averages

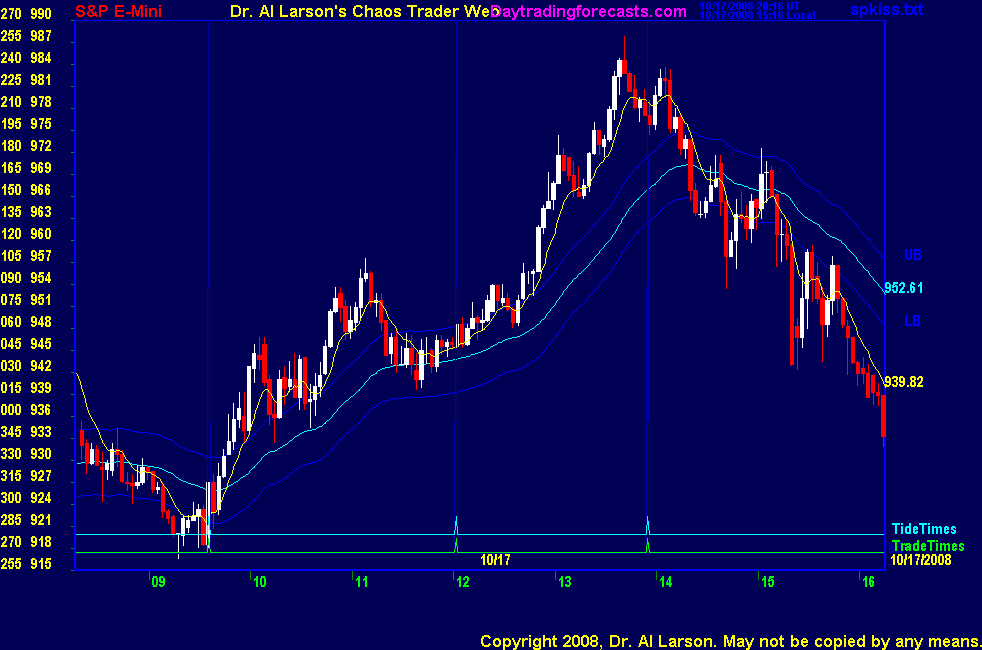

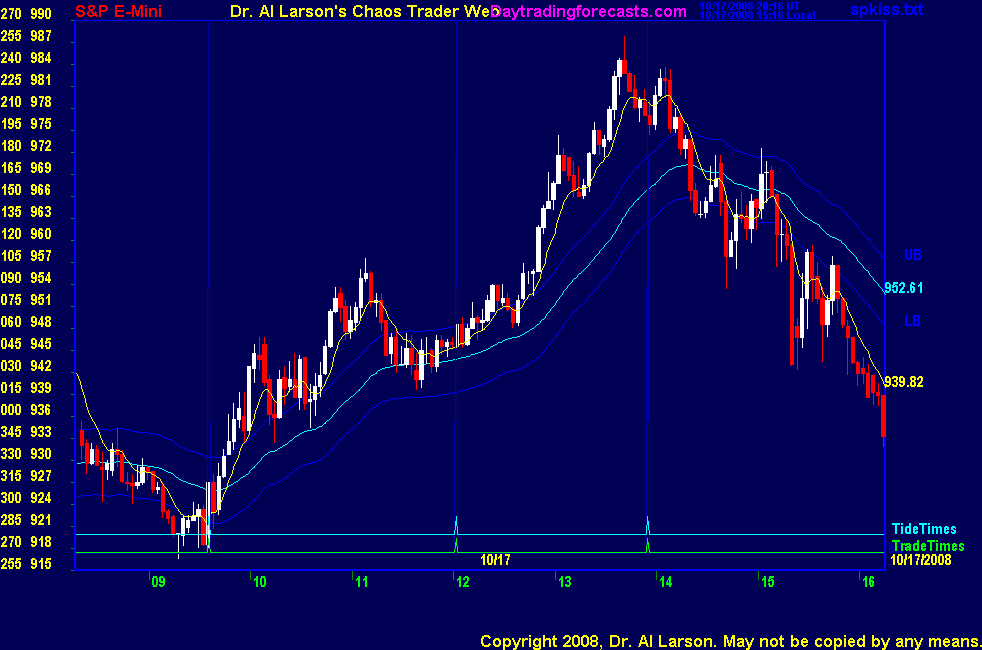

2:15 110 is curling over, so maybe we will get a trade here; my focus will be on the SPKISS chart

2:09 lower high, so turning down

2:03 this is also pretty far from the 110 EXMA to do a continuation buy, so I'm just watching

1:52 I would not take it, just because I know this is a "2 Moon day, often volatile and one way" , so I expect the market

to hold up into the Moon T180 timeline

1:49 some time ago I removed the Out of Band trade simply because it has a lower win rate than the trend trades

this is one place where it might work fro a modest pullback

1:43 coming to the high in the red -Tide. Watch for a down turn

1:36 no letup in buying; have a resistance point at 984.75

1:12 this last move looks like all part of move 5 up in the two day fractal, so I expect a move 6 pullback, and a move 7 up

into the close

1:06 on the MTRAinbow chart, the extremes have reen running about 36 points from the 400 EXMA; there now

1:02 on the SP1Day are listed the Pit Pivot prices, rules of thumb used by pit traders

The Pivot was 918, and Resist 1 is 972

1:00 got an inversion from green +Tide to red -Tide about 12:10

12:48 someone who trailed their stop looser would have gotten their +9; not the first time I flinched, and won't be the last :)

12:36 as a fractal gets older, the thrusts in the direction of the fractal get weaker, so I was nervous on that trade

I saw the 20 EXMa rolling over, and that told me my 50 stop would probably get hit, so I aborted

12:32 aborting 51; do not like it; slope of rally much shallower than early moves

12:29 stop 50

12:23 stop to 49, cover is 57.5

12:12 stop 44.5

12:01 getting a continuation buy-bought 48.5 stop 40.5

11:53 still stuck in congestion

11:48 looking weak

11:42 110 held flat, so no trade setup yet; need > 49 for a buy, <39 for a sell

11:38 rolling over ; waiting for a crossing of the 20/110

11:30 110 has flattened, supporting price, but curl is down, not up

11:21 dropped back below yesterday's highs; should attract selling; possible 12:02 trade if get a 20/110 sell

11:15 in today's rally, I see 7 moves, so it may be done

11:10 the 12:02 trade may not set up- quite far from the 110 EXMA

11:00 Look at the MTRainbow chart. Take your finger and trade the moves from yesterday's low, feeling the swings.

Trace 7 moves. This is a simple way of looking ahead. Can you find the End Of Fractal?

10:52 new highs for today and broke yesterday's high; move 5 of 7 in up CC about done

10:40 if we do not break yesterday's high by 11:00, we should see selling

10:36 now trading inside the range with a lower high - so I expect congestion

10:22 range is 30 points , nice 1/12 of circle

10:14 now you see why I took 9; This market is both volatile and fickle; lots of angst

10:09 Stopped by Chiron/Node flux at 945

9:56 In this very wild market I have been just taking 9 when offered. The high volatility means greater risk, do

I have been conservative. It's not what you see on the chart, but what you put in the bank that matters.

9:54 out +9

9:52 stop 925

9:45 bought 930 stop 920

9:40 9 point bars--risk is high

9:37 just passed Moon timeline, looking bullish

9:34 close to first trade time -just watching for now-pretty quiet

9:19 the 440 EXMA acts as a centerline for the day; 2 day pattern says in move 4 of 7 in up Chaos Clamshell

9:15 selling off pre-outcry; down to 400 EXMA on MTRainbow

9:00 Good morning from Chaos Manor

Besides the comments made by Al, the chat room is has live

comments from other traders who sometimes share their views,

trades and tips. Below are the chat room comments from this clinic

10/17/2008 1:08:58 PM Mountain DP:: Thank Al. Good teaching today. Have a great weekend!

10/17/2008 10:52:41 AM Mountain Al:: No, I find it very dangerous to trade over a weekend, with all the government surprises. Even overnight is more risk right now than I like.

10/17/2008 10:47:20 AM Mountain mag:: Dr. Larson , since you expect a low on Monday according to the XGO, and as I interpret it there will be a big gap down on the open, do you recommend to short position on the close today? or is this to premature?

10/17/2008 10:18:27 AM Mountain AP:: Ok..no problem Al

10/17/2008 10:16:12 AM Mountain Al:: AP-we were getting lots of big bar chop, so I waited to see how the 20 acted, it faded fast, so I waited

Please send me an email when you have a question, because no one else can tell you why I did or did not do something

On Fridays when I do the Chaos Clinic, please stick to today's stuff

10/17/2008 10:11:30 AM Mountain AP:: Hi, would one of the regulars here please explain why there was no buy trade yesterday at 13.15, as it wasn't listed by Al. Both thje 20 and 110 EMXA both turned up. Just trying to understand. I noticed my prior comments were deleted. I hope this was by accident for some reason.

10/17/2008 8:28:25 AM Mountain DP:: Well done Al. Nice trade. I second the comment about ignoring the chart and paying attention to the bank. Cheers!

10/17/2008 6:45:25 AM Mountain mm:: gm all - have a great day

9:00 Eastern-System: No comments

[ Live Clinics on Friday on DaytradingForecasts.com ]