Chaos Clinic Recap

Here are Al's comments

2:10 I think I'm going to call it a day, and pass on the last two trades. I just don't see much potential. Thanks for coming. See you next week. Take a course.

2:05 OK, not going down ; and unlikely to make new highs

1:57 I may pass on the last two trades - don't see a big move either way right now

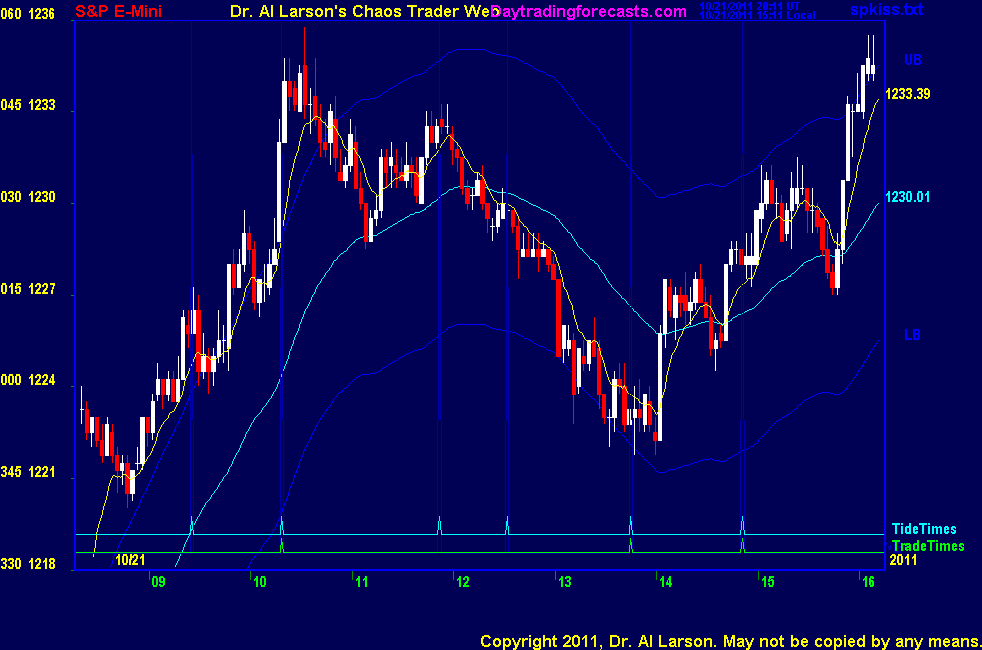

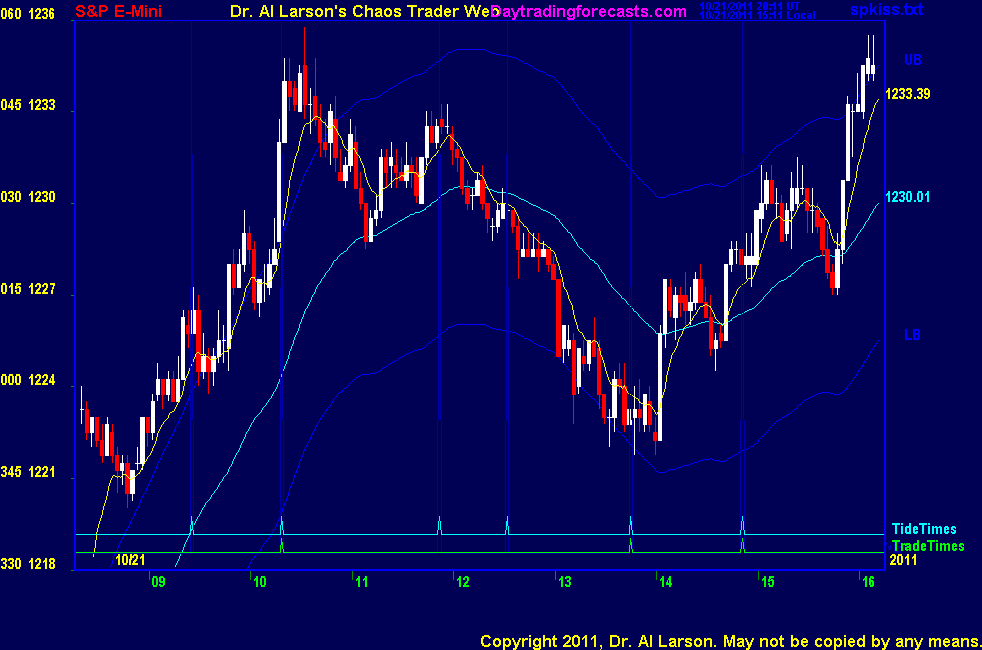

1:50 last hour looks like tracking the green +Tide

1:40 yesterday was a "V" day. Today looks like and "N" day

1:37 bent but did not break the 440 EXMA

1:34 my best guess is that we close about 1229 on the Sun +H180 electric field flux

1:31 the 20/110 gave a sell near 1230-now too far down to jump in short, so just watching

1:15 sold off to the 440 EXMA - usually do not get a gap up and a big decline on Fridays, so I expect the market to hold up

1:03 BBB's comment in the chat room about me not taking my +9 is out of chartacer is correct. I had a bit of

middle of the night insomnia, so I'm sleep deprived. So considering how I feel, I'm OK with what I did do.

1:00 I'm back - see that I did not miss much. Covered my overnight swing trade 1230.25 for +21.25

12:10 taking another break until near the next trade time of 1:45

12:05 out for 0-not moving

11:46 back - rebought 1231 stop 1228

11:08 stopped for +3. My gamble failed, but at a profit. Taking a breakfast break now.

10:49 stop to 1229

10:38 stop to 1228 -lock 2. Ordinarily, I would take a 9 point gain. Today's momentum tells me I may get much more.

To judge the momentum, look at the MTRainbow chart. The dips have not even touche the 55 minute EXMA.

10:21 last night I posted a chart in the Certified Chaos Trader's Room showing the end of the 9 day congestion, using a congestion ellipse.

That room is open

to graduates of my 4 main courses. See http://moneytide.com -> Courses for details.

10:18 stop to 1226- I will just let this one run

10:12 yesterday I used a technique taught in the Chaos Trading Made Easy course to estimate the potential of this rally.

It came out 1250.25. We shall see.

10:00 stop to 1224

9:55 there was a 20/110 continuation setup there. The dip was only about 10 minutes long. The hedge fund

high frequency computers do not give you much of a chance to get it sometimes

9:50 stop to 1223.5 ; I jumped because the 110 EXMA is moving fast -about 6 points per hour

9:47 can't wait-bought 1226 stop 1223

9:45 I'm trying to wait until after the trade time

9:42 swing low 1223.5 , swing high 1227.25 ; this is a narrow opening range

9:40 20 EXMA has turned slightly down

9:31 outcry session now open. 110 minute EXMA up, now near 1219.82. Watching for the 20 EXMA to dip toward it.

9;24 as a day trader, one has to not get frustrated by big overnight moves. One day trades to eliminate

the risk of such moves going against you. You just have to be patient and get in when the conditons are right.

9:19 there is the possibility that today could turn into a rally all day type day. Hopefully, there will be a change

for a day trade entry near out trade times

9:14 also on that chart, the 440 shows that yesterday was a change in day trend day, with mid day low

This is a good setup for an overnight swing trade. I did take it with a buy at 1209, stop 1202. Stop now 1219.75

9:07 on the MTRainbow chart, the white 440 EXMA is up, so trend of the day is up.

but it is about 14 points below price, so there is room for a pullback. Normally,

on a gap up day, there is a pullback into about 11:00

9:01 gap up overnight; 3 trade times today: 10:19 13:45 and 14:51

9:00 Good morning from Chaos Manor

Besides the comments made by Al, the chat room is has live

comments from other traders who sometimes share their views,

trades and tips. Below are the chat room comments from this clinic

10/21/2011 2:14:58 PM MT Tg****:: Al was right about the "N" pattern.

10/21/2011 1:05:12 PM MT Sculler:: Hi Al, I know it's not the forum, but I can't get hold of you via the web email - will u pls reset my MTR reader? Thanks, D van Es

10/21/2011 11:24:26 AM MT BBB:: I gave away the keurig the second i tried one of these machines. It keeps beans in a little drawer and grinds them on its own, packs them, and spits out perfect espresso. The Keurig does not even compare. I love it too, but this thing is amazing.

10/21/2011 11:20:47 AM MT Al****:: BBB-already exercised my Kuerig heavily :)

10/21/2011 11:18:02 AM MT Tg****:: By my count this is a move 6 of 7 from yesterday's low though today's high did achieve about the minimum one would expect a completed up fractal to get to based on yesterday's rally off of the low.

10/21/2011 11:13:21 AM MT Tg****:: Good sized gap up day and a run to new multiday highs...on these sorts of days the 110 often won't be breached by more than a point so I can definitely see why one would try to let that run. Especially after having a very good overnight trade.

10/21/2011 11:08:46 AM MT BBB:: Al -- Jura espresso machine. Expensive, but the best I have ever had, better than that Starbucks place everyone talks about.

10/21/2011 10:28:19 AM MT srj****:: mm, Thanks (tells me where to focus), still familiarising my self with MT, the standing rules and the past clinics before I go "live".

10/21/2011 10:26:18 AM MT BBB:: it seems like Al is picturing a big move, maybe not today, but for him to hang onto the trade with the stop at +3 versus taking his 9 points seems out of character, that is why I said congestion now and run up later...

10/21/2011 10:09:06 AM MT JMV****:: I'm having a hard time picturing a big up move towards the end of the session. So much "headline risk" today I don't see big money making huge commitments one way or the other... More than they have already, that is.

10/21/2011 10:06:56 AM MT mm****:: srj - you have 4 stars but you call yourself a newbie - LOL ? The S/R levels are listed on the SP1Day page - IMHO: there is only ONE pivot, the rest are S or R levels depending on whether they are below or above the price - I follow Al' advise in his daily email: "Don't be intimidated by all the Astro stuff ..." - I just follow his MT religiously

10/21/2011 10:05:29 AM MT BBB:: Think this is another runup, congestion, run up kind of day?

10/21/2011 9:46:05 AM MT srj****:: BTW guys Thanks, all the comments below are great for a newbie like me.

10/21/2011 9:44:29 AM MT srj****:: @mm Is the 1228.50 S/R level from the 110 or is that daily pivots? and is the 1232.5 some resistance level or a Mars planetary line ( sorry I am a newbie). TIA

10/21/2011 9:31:30 AM MT mm****:: As I wrote a few days ago: when price hit the 1232.50 R level at the 10:19 MT CIT time: I took my profit - By the way: Al's stop disregarded the 1228.50 S/R level - he would not have been stopped if the stop had been BELOW insted of above - the importance of the S/R levels cannot be over-estimated - IMHO

10/21/2011 9:13:57 AM MT JMV****:: Agreed. Sometimes if I feel like gambling I'll simply move my stop to my desired target and trail it from there instead of taking profits outright. I don't allow myself to gamble any more than that, but that's just a personal preference.

10/21/2011 9:09:57 AM MT AG:: With you on volatility targets - also use them. I suppose I'm referring to those special days when the art of trading comes in, but nothing beats discipline over the long term.

10/21/2011 8:58:23 AM MT JMV****:: In my own work I have found that having targets is more consistent if not profitable then just letting things run forever. Although I don't trade the ES much.

It's always a good idea to set one's targets based on volatility, but with no targets whatsoever, sometimes you end up leaving quite a bit on the table.

I daytrade trade mainly FX, and I know that 100 pips in one trade is spectacular, so that's my max target, if I hit it, I won't take my chances, I'll just take the money and run.

10/21/2011 8:45:43 AM MT AG:: What Dr. Larson is trying to do right now is exactly what I'm working on - 'really' letting your winners ride. One thing is to have a good day but another is to have a 'really' good day. Those outsized profits are what differentiate good traders from very good traders.

10/21/2011 8:22:57 AM MT Tg****:: understand, there was a 20/55 pinch and go and sometimes that's all you get in strongly trending market.

10/21/2011 8:15:38 AM MT Al****:: all I was looking for was a dip-given the speed

10/21/2011 8:15:00 AM MT Tg****:: On the 24 hour exmas, there was a nice 20/110 pinch and continuation just under 45 minutes prior to the 9:26 timeline.

10/21/2011 8:10:27 AM MT Tg****:: Al, I didn't see a 20/110 pinch. It was pinched to the upper out of band, though.

10/21/2011 7:49:28 AM MT srj****:: yes just amazing - (thanks for pointing it out mm)

10/21/2011 7:39:04 AM MT mm****:: The MT look hot today - that 9:26 was right on the money.

10/21/2011 7:35:41 AM MT srj****:: gm all - beautiful day here N of Boston.

10/21/2011 6:39:53 AM MT EOE:: GM everyone. its another beautiful fall morning. good luck.

10/21/2011 6:31:36 AM MT Al****:: GM all-good luck today

10/21/2011 5:43:12 AM MT mm****:: gm all - have a great day

9:00 Eastern-System: No comments

[ Live Clinics on Friday on DaytradingForecasts.com ]