Chaos Clinic Recap

Here are Al's comments

1:02 I am going to pass on the last two trades-I've worked hard enough. The charts will run to close.

Have a great Holiday Season and a Prosperous New Year. Next Clinic will be 1/6/2012

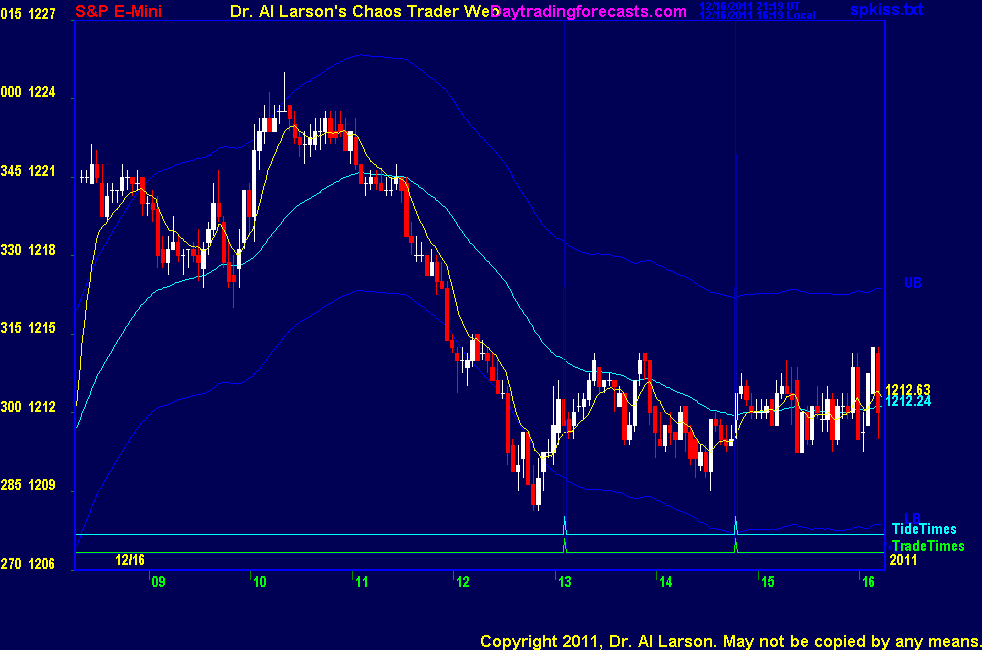

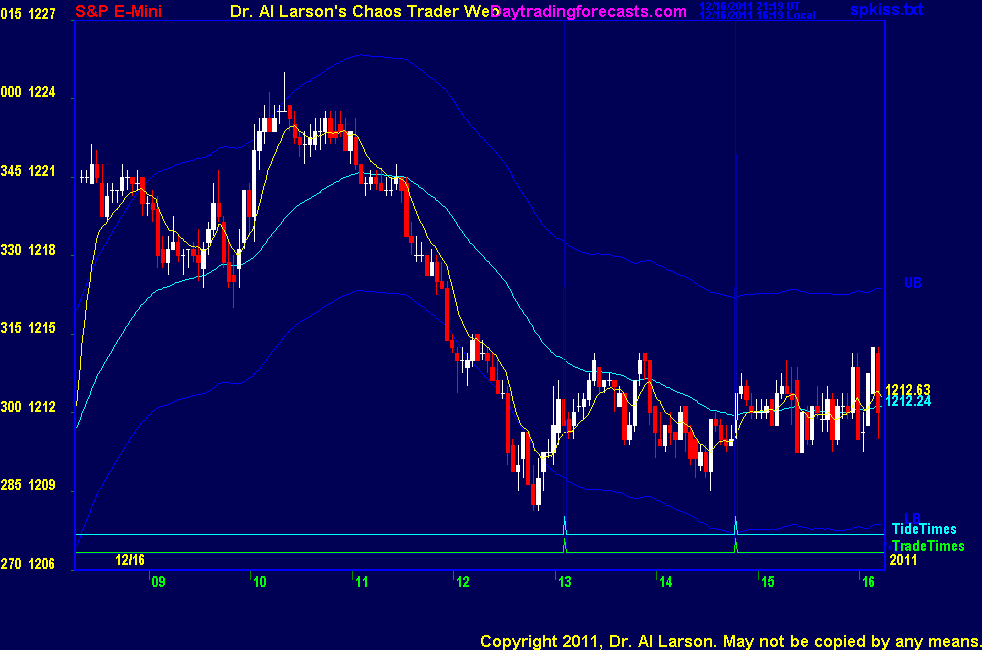

12:59 On the AUX page I have posted a bit of research in progress-a Tide Tracker chart with the

MoonTides scaled to match the actual move

12:46 for reasons I don't understand, the MoonTides have not tracked well after 1:00 the last two days.

I suspect is is due to traders leaving early. Even those who use computers need people to watch them

12:42 I had my cover order in as soon as I sold, and I did get filled at 1209.

12:40 how did I get the 1209 target? I looked at the S&P TideTracker 3 point quantums and took the nearest one.

12:37 out for +5; what I did there was to realize that we were on the green +Tide; i had missed a good entry due to distractions.

so I took a couple of small bites.

12:34 stop 1213-cover will be 1209

12:32 I did resell at 14 stop at 15 now

12:22 the TideTracker chart got it all

12:12 day's range expanded from 9 to 12.25 points; 1/8 th and 1/6th of the Wheel of 72 respectively

12:10 covered for +2; just a scalp

12:03 on the MTRainbow chart the averages rolled over sharply

12:01 in my own account I did sell 1215 stop 1216

11:59 it fell-trend has chnaged to down; the obvious in hindsight trade was a sell at the 10:35 time

11:56 testing the low of the day

11:51 dipped below but back up to it

11:47 440 EXMA held - at least for now

11:45 down to the 440

11:35 a bit of selling -watch for support on the 440 EXMA

11:22 I have placed a Fractal of Pi chart in the Certified Chaos Trader's Room. That room is open

to graduates of my 4 main courses. See http://moneytide.com -> Courses for details.

11:13 I'm back trade has slowed-holding on the Mars/Node flux; on MTRainbwo chart, 440 EXMa is solidly up

so it looks like flat to up from here

10:40 I'll wait until the next Trade time-taking a breakfast break

10:30 I pressed my stop to breakeven because it was not a great entry; I can always rebuy

10:28 out for 0

10:25 support on the Sun flux

10:20 stop to 1222, just under the 20 EXMA

10:13 this energy is coming from the Mercury-Moon 40 day cycle-so famous it is in the Bible several places

10:12 stop to 1220.5, just under the 1221 level

10:04 bought 1222 stop 1220-continuation buy-entry is late

10:02 aborted for -1.5; did not like it hanging aroung the Moon flux

9:57 very choppy-high retested, rally stopped at Node flux; stop OK

9:52 I jumped in because of the spike nature of the high at 1221.25

9:47 breaking 110 EXMA and 20 crossing 55-early, but selling 1217 stop 1222

9:45 below them is the Moon/Mercury flux pair-see SPSunMoonMer chart

9:43 this resistance at 1221 is due to Mars and Node electric field flux lines

9:42 so far looks like following green +Tide

9:40 on the charts there is no pipper for the 10:35 time, because my software did not pick it as a Tide Time. I added it manually.

9:35 trade times today are 10:35, 13:06, and 14:47. The last few days all the volatility has been early, so

only the first may be useful

9:32 my first impression this morning is to go camping-unfortunately the campgrounds in the Rockies are under about 12 feet of snow

9:29 opening up, but with low volatility is midnoght Eastern

9:00 Good morning from Chaos Manor

Besides the comments made by Al, the chat room is has live

comments from other traders who sometimes share their views,

trades and tips. Below are the chat room comments from this clinic

12/16/2011 1:24:50 PM MT bbb****:: Have a great end of the year Al- so

Thankful to have found your service. Thanks again.

12/16/2011 11:23:24 AM MT srj****:: Thanks Al. Happy holidays.

12/16/2011 11:11:18 AM MT Al****:: Wheel of 72 /8 = 9; 72/6 = 12

12/16/2011 10:25:46 AM MT srj****:: @AL - your FOG chart from this morning seemed to indicate a strong possibility was for the market to go down (at least that is what I read it as - if that is correct).

I did not quite follow how you figured out the range expansion from 1/8th to 1/6th please explain (CCT room if that is where it should be) Thanks.

12/16/2011 10:21:43 AM MT srj****:: @mm - have heard of forex traders who use just the Pivot an S/R levels.

12/16/2011 10:11:03 AM MT mm****:: Isn't it pretty how price moves from one S/R level to the next?

12/16/2011 8:46:28 AM MT srj****:: Thanks BBB - a live example is always great.

12/16/2011 8:20:24 AM MT BBB****:: srj - updated chart in CCT

12/16/2011 8:06:03 AM MT BBB****:: Replied in CCT room SRJ

12/16/2011 7:45:17 AM MT srj****:: Hi BBB - I put in the question in to the CCT room. Thanks.

12/16/2011 7:40:41 AM MT srj****:: Thanks Al - I will revisit my checklist with your comments.

12/16/2011 7:38:36 AM MT srj****:: Thanks AG - I too have noticed on some days the juice is easy to see (when the market is moving) and when slow I get faked so it is as you say I also thought it is a matter of getting a better feel for it - on some days it is clear when the market takes off smoothly in the MT window, on others when the move is not that well defined I get faked out. I will check out the 3 min bar on completion entries. Also when using CTME Fractal grid the 2 point works well most of the time. FYI - for the exits I use Al's rules - I tried finnessing the exits using various methods and on average they all performed much worse.

12/16/2011 7:30:31 AM MT BBB****:: srj - you were asking me somehitng in the CCT room yday - if you want to go in there and ask again I will try and reply

12/16/2011 7:20:58 AM MT Al****:: GM all- good luck today

MM: if you check the hotline writeup, I did add the 10:35 time

SRJ: I just keep and eye on the range of the last one or two days - once it drops below 12 points, the juice is pretty weak,

so trades are riskier, and I use about a 3 point stop, above that I use a 4 or 5 point stop. when the volatility is greater, the EXMA's work better and it is easier to get good trades.

12/16/2011 7:17:13 AM MT AG:: srj, I have always traded intraday with 2-point stops in virtually all markets (excluding 2008). On very volatile dcays I am more picky about my entry price than usual, but will still hold the position with a 2-point stop. I know the rules use 3 points but I have found 2 is enough. I use 3-min bar charts and typically wait for the bar to 'complete' before entering. You may want to use this if you're getting stopped out. For me, 'juice' is defined by how quickly/briskly the tape moves. Other than that it's hard to explain. I've developed a 'good feel' for when there is momentum. That's my 2 cents...

12/16/2011 6:40:00 AM MT srj****:: Al/mm - yesterdays answer on the exits were good. To me the exits were relatively easier to follow. I have more difficulties with the entries and stops. (1) for the entries I use the 1 min 20/110 EXMA cross but have been often stopped out - probably could not quite interpret "if there was enough juice" before jumping in and the market then reverses - any ideas on this?

(2) for the stops on volatile days can you clarify how to check the "day range" and how many points to use for the stop? Is the day range the morning move or is it the previous days range (or some mix of these) TIA

12/16/2011 6:33:12 AM MT srj****:: gm all. Happy holidays. Al thanks for the FOG chart update.

12/16/2011 6:26:04 AM MT mm****:: Al - I hope you don't leave too early, since both trades are in the afternoon - but also: you may want to check whether your computer missed the MT CIT at approx. 10:30 AM as a potential trade

12/16/2011 6:22:57 AM MT mm****:: gm all - have a great day

9:00 Eastern-System: No comments

[ Live Clinics on Friday on DaytradingForecasts.com ]