2:53 I'm done for today and the year; see you in 2015. thanks for coming; take some courses; Happy holidays

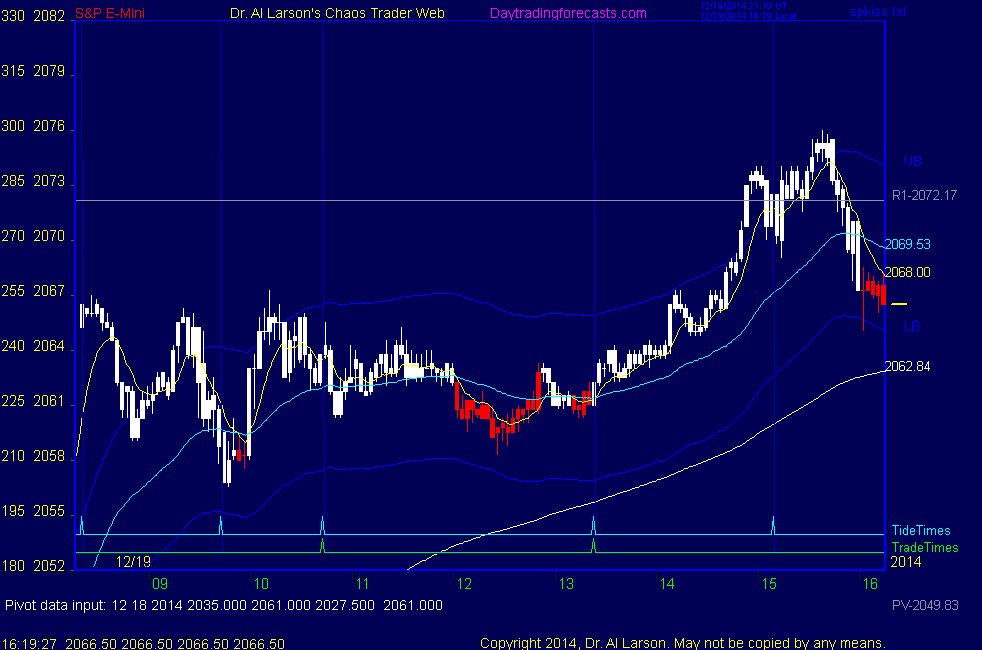

2:52 out at 2072 for +10.5

2:50 stop to 2067

2:48 stop to 2066.5; lock 5

2:44 stop to 2065; I will accept a 2072 price if I get it; my sell lmit order is in

2:37 from doing my Chaos Trading Made Easy homework, I know this is a "hold to close" pattern

2:35 stop to 2064.5 - lock 3 ; nice divergence on the EXMA Rainbow

2:32 the green +Tide turns down at 15:09 - that's just a forecast-I'll note it but watch my tracking EXMA's

2:30 if we break 2067, we could see a short covering rally

2:27 that may mean holding to the close; last hour yesterday was a gangbuster

2:26 here I'm watching the 55 minute EXMA - I want to stay in as long as it is up

2:18 testing 10:00 high; needs to break it within 27 minutes

2:13 stop to 2064; I think we go up and test the overnight high

2:08 stop to 2063 (55min EXMA) , lock 1.5; adjusting cover to 2072 again

2:03 adjusting my cover limit back to 2067

1:52 may get an acceleration soon-MoonTide gets steeper ; stop to 2061.5, breakeven

1:47 now prices staying one side of the 110 and getting some EXMA divergence-good

1:42 on the MTRainbow chart the 440 EXMA is still up, and the 220 provided support

1:38 I will cover on time at 3:09 if still in

1:37 that's too close, stop back to 2060.5

1:33 raising it and moving stop to 2061.5; breakeven

1:32 if this move gets going I'll raise my cover to the R1=2072

1:31 stop to 2060.5; risk 1

1:26 stop to 2060, risk 1.5; putting my cover sell limit at 2067

1:23 here I'm just betting on the green +Tide

1:18 looking OK; 2060.5 was support

1:00 got it; long 2061.5 stop 2058

12:55 trying buy limit 2061.5

12:53 missed all the good entries-those orders needed to be in place earlier

12:49 also placing buy limit 2060.5 , next level up

12:46 trying the algo mentioned earlier, placing buy limit at 2059.5, one tick above the 2059.25 ; may or may not get filled

12:44 we are unlikey to get a classic hotline setup here;

12:40 the market has held it's early low for 2 1/2 hours, so not going down

12:29 out for 0; cover should have been 2058.25 on the natural resistance

12:27 stop to 2060; breakeven

12:26 stop 2060.5

12:24 not a hotline trade, sold 2060 stop 2062 cover 2058

12:21 I have a Fractal of Pi pattern suggesting we could drop to 2058.25

12:19 hanging around yesterday's close

12:09 right now following green +Tide

11:58 the MoonTides do add value to this type of day, and may give some algos that work; For example,

if at the next trade time of 13:32 prices hit 2064.5 one could sell 2064.5 limit; or if they hit 2059.25 buy that on a limit

11:55 there are algorithms for trading this type day; but you have to be running a "flash box" to use them.

these are fast computers collated in the racks with the exchange computers.

11:50 on the AUX page chart there is a simulated autotrader, which just buys and sells the 36/220 minute EXMA crossovers;

It got a false signal on the 9:43 dip, and took a 5 point loss. That's what I mean about

"the EXMA's will give false signals, so I'm keeping my powder dry "

11:42 we also tend to get mixed Tides, forming a MoonTide Fractal set, the market equivalent of the Mandelbrot set

11:38 under these conditions, the market fractal works on a small scale, reducing the swings. Natural support

and resistance levels compress. On the AUX page I'm showing my lowest level support/resistance chart

10:55 I'm going to pass on this first trade; I don't like the lack of a real trend ; I'll be back for the second one

10:40 you have to recognize what the trading climate is - that you are seeing today are warring computers battling go a draw but milking one and two tick profits

10:32 in these conditions, the EXMA's will give false signals, so I'm keeping my powder dry

10:21 unless we break out of this trading range I'm not interested in risking my money

10:19 this first trade may be a pass

10:13 I'm not nimble enough to catch 20-30 minute reversals

10:06 so far we are in the 2056-58 to 2067 trading range I expected

10:02 that is a big 3 minute bar - about 5 points; no real net change; not good for us peons

10:00 getting some Moon Juice off that T0 timeline

9:55 the trick today will be to take profits quickly; 2 or 3 points - choppy and lower volatility

9:49 prices have squated on the rising 440 minute EXMA - support forming

9:46 from the overnight high this is the 7th move down, so the selloff may be ending

9:41 we have the Moon T0 timeline near 10:00; currently trading under the Moon T+000 fluxline

9:33 I have support at 2056 and 2058 and resistance at 2067 suggesting a narrow range

9:31 one thing I want to see is how jumpy prices are - how big are the 3 minute bars? is there any net trend?

9:27 we may get a narrow range, so it is good that the first trade is not until 10:43; gives us time to evaluate things

9:12 2 today's trades are near 10:43 and 13:23

market looks to have topped out overnight, so I expect lower volatility on this quad witching day

9:00 Good Morning. Welcome to the Chaos Clinic. This site has a lot of charts,

so you may find it useful to have several of them available within your

browser. If you have a tabbed browser, you can open separate charts

in separate tabs by right clicking on any link, and selecting "open in new tab"

from the menu. The main list of site pages is at

http://daytradingforecasts.com/chartlistsec.asp

Recommended pages to watch are SPKISS, MTRainbow, and Chat.

For astro stuff, add SPSunMoonMer, Wheel, and Chaos Clinic.

Chaos clinic comments appear at the bottom of the SPKISS, MTRainbow,

and ChaosClinic pages. Comments in the chat room are announced by a

"duck call" noise. This noise also occurs when the sofware detects a

resonant hex pattern on the Wheel page. Trading tutorials

are on the right side of the ListOfCharts page. One should

read Trading the MoonTide Tutorial and Keep it Simple as a minimum.

9:00 Eastern-System: No comments