|

Cash In On Chaos Course

|

The Cash In On Chaos course is a home study course

which teaches Dr. Al Larson's unique Chaos Market Theory.

This theory explains market behavior in terms of Chaos Theory.

This is the only true scientific course on chaos in markets. It can be used to develop your own trading systems.

Markets are provably chaotic. They go through periods of

relative flat prices, then break sharply higher or lower, then

return to relative calm. This is typical of chaotic systems,

and can be explained in terms of chaos theory. The basics of

chaos theory is taught, with no more math than addition, subtraction,

and multiplication.

Traders can use Chaos Market Theory to stay out of the calms, and catch the

chaotic moves.

| "After this course, I'll never look at markets the same again."

HK-commodity trader with 25 years experience

|

But theory by itself is useless, unless it leads to practical

results. This course reveals the Hannula Market Fractal,

a pattern that exists in all freely traded markets.

This fractal pattern can be used effectively to understand the development

of a market move, and to forecast its extension in both time and price.

This provides the opportunity to identify good trading opportunities.

This fractal is provided in the form of precision

eMylar overlays. These overlays are tranlucent windows, which can be placed on any chart

on your computer, from any source. As the pattern develops, you can find the most attractive places to trade.

The course takes about 6 hours

to do. This course is available only online. Requires non-disclosure.

|

Cash In On Chaos Course

Outline

1. What Chaos is

-system concept

-linear systems

-non-linear systems

2. Behavior of Non-linear Systems

-state space

-strange attractors

-strange repellors

-tests for data series

3. Limit Cycles

-linear and non-linear

-finding on charts

4. Frequency shifts

-frequency doubling

-fibrillation

-tracking with Zero Delay filter

5. Fractal Dimension

-Mandelbrot's Fractal Geometry

-Fractal dimensions of Coastlines

-Polarized Fractal Efficiency

( a trading indicator)

|

6. Fractal Patterns

-algebraic

(only place you use math-

and that's on a calculator)

-geometric

7. The Hannula Market Fractal

-Basic Shape

-Variations

-Structure

-Measures

-Projections

8. Trading Examples

-Entry Points

-Exit Points

-Hannula Hook

-SAR

9. Sources of Market Chaos

-Market AstroPhysics

-Sources of Non-linearity

-Examples

-Lunar Chaos Theory

10. Conclusion

-Summary

-Software demo

-Reading references

|

|

Knowing how chaotic systems behave gives you a trading edge. Knowing how markets form their

fractal patterns sharpens that edge.

The fractal patterns taught in this course occur in all freely traded markets, on many time scales. Day traders will find

fractals measured in hours. Swing traders will find them measured in days. Position traders will find them measured

in months and years. After taking this course, the student is encouraged to find the last fifty fractals

in their favorite market. They will find that fractals occur only in a small number of sizes, which fit

the set of sizes provided in the precision fractal overlays. Then, knowing which size fractals

a market forms, the trader can usually quickly find the size of the one being formed, and track

its development. Certain points in the fractal present low risk trading opportunities.

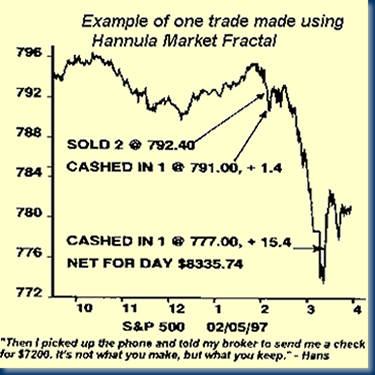

Finding them gives you a trading edge. One example of many is shown at the right. This was a day

when I identified a key point in the fractal pattern and traded it well. I use this as an example because this trade

was made using only the material taught in this course. There are, of course, many other examples.

The fractal patterns taught in this course occur in all freely traded markets, on many time scales. Day traders will find

fractals measured in hours. Swing traders will find them measured in days. Position traders will find them measured

in months and years. After taking this course, the student is encouraged to find the last fifty fractals

in their favorite market. They will find that fractals occur only in a small number of sizes, which fit

the set of sizes provided in the precision fractal overlays. Then, knowing which size fractals

a market forms, the trader can usually quickly find the size of the one being formed, and track

its development. Certain points in the fractal present low risk trading opportunities.

Finding them gives you a trading edge. One example of many is shown at the right. This was a day

when I identified a key point in the fractal pattern and traded it well. I use this as an example because this trade

was made using only the material taught in this course. There are, of course, many other examples.

This course has stood the test of time. Since it's development more than a decade ago,

it has been used by traders world-wide to gain a competitive trading edge. Graduates

of this course are eligible to take the Fractal of Pi course, which further

develops the fractal pattern, identifying more detail.

The Cash

In On Chaos Course may be ordered electronically by

Clicking Here

"Highly recommended."

- Larry Jacobs, Trader's World

"...has real merit. I think this system could be traded with positive results."

- Robert Flores, Stocks and Commodities

"We are able to see the fractals quite well. Thanks for sharing."

- SM-Chicago

"I prefer that not too many people have these money making techniques."

- LVH-Netherlands

"Fascinating approach to the markets. I was thoroughly impressed with your use of fractal analysis. It is a unique approach that makes a great deal of sense."

- TM-New York

"I learned several new things from the Cash In On Chaos Course. I highly recommend it."

- Larry Pesavento-Arizona

"We've been doing much better since taking your course last summer."

- DD-Oregon

"Al's Cash In On Chaos course is clear, concise, and captures through simplification

the essential essence of his chaos work. The course should be helpful to anyone who desires to increase their knowledge of the markets."

- Dr. Greg Meyer-Arizona

|